You’ve Got Options When It Comes to Home Financing

There are many mortgage options that can help make purchasing and maintaining a home more affordable.

Low down payment mortgage options, loans for manufactured homes, and a variety of renovation loans are all available to suit different buyers’ needs. It also helps to research these options before you find a mortgage professional who can help you choose the best one for your financial situation. Here are some options to explore:

Low down payment mortgage options

Balancing everyday expenses while also saving for a home purchase can be challenging. Fortunately, today’s buyers have mortgage options that allow for down payments well below 20% of the home’s purchase price. Some may even be able to buy a home with as little as 3% down.

Homeownership education requirement

In order to qualify for a HomeReady, HFA Preferred, or 97% LTV loan, you may be required to complete homeownership education.

Fannie Mae HomeView® is a comprehensive online course that is offered free of charge and can be used to satisfy the requirement.

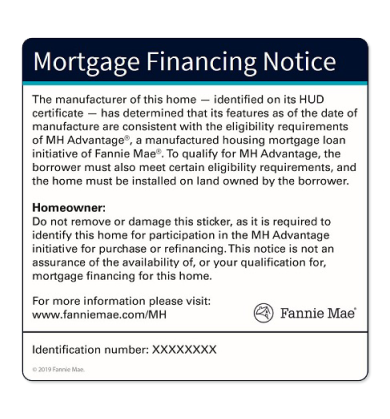

Affordable mortgage options are available for manufactured homes

Manufactured homes can be a more affordable option compared to site-built homes. There are a variety of modern, attractive models built to high standards with many of today’s sought-after amenities. Manufactured homes can come with attached garages, upgraded kitchens and bathrooms, energy-efficient appliances, and architectural features that blend seamlessly into a variety of neighborhoods. The main difference is they’re built indoors in efficient state-of-the-art facilities, and then delivered and installed on your chosen home site.

Mortgage options for homes needing renovations or energy updates

If the home you love is just in need of an upgrade, there are affordable financing options for renovations and energy updates. And to make it easy, you often get to work with the same lenders you’re already working with for your mortgage.

Even more affordable options for homebuyers

There are many additional affordable paths to buying property and building equity for your future.

Many types of affordable mortgage loans are available to homebuyers with options to suit different income levels and financial situations. Learn about as many as you can so that you can make an informed decision about your future as a homeowner.